YOUR CHALLENGE IS TO MAXIMIZE CREDIT LIMITS AND SALES AND MINIMIZE SLOW PAY AND BAD DEBT

We have a range of credit services tailored to assist you in this challenge.

We offer credit recommendations on both domestic and international companies. Recommendations are customized versus your risk-tolerance, industry and credit policy.

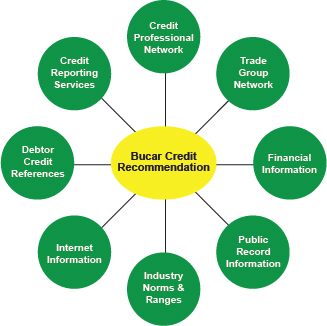

Bucar Group has assembled a network of credit professionals across many industries, with national and regional expertise. This trade group-like alliance is privy to the most reliable and up-to-date information. They provide consultation to Bucar analysts on many credit recommendations.

Along with this credit professional network, we research multiple sources in order to provide complete, accurate and timely recommendations. We utilize automated information, but we also seek “real-time” information that the reporting services may miss. As a result, you get the best of both worlds!

We are a preferred solution for Asset-Based Lenders, Accountants and Lawyers who seek to minimize credit risk on behalf of their clients.

In credit situations where you require more confidence that you’ll get paid, Bucar Group offers debtor and credit enhancement services aimed at providing you with the particular certainty you need. Among the credit and debtor enhancement tools we recommend and could completely render on your behalf:

- Personal guarantees from the principals and/or corporations*

- Purchase money security interest in equipment or inventory being provided*

- A mortgage lien on real estate owned by the customer*

- Assignment of accounts or contracts directly with your customer*

- UCC filing

- Letter-of-credit

- Monitoring service

- Act as an intermediary between you and your customer (new or prospective) to garner important pieces of information currently unavailable to you.

*Bucar Group collection lawyers are involved with the structure and execution of these enhancements.

CASE STUDY – CREDIT SOLUTIONS CUSTOMER

WELDING, INDUSTRIAL AND SAFETY DISTRIBUTION

Situation:

The credit department’s credit decision for new customers is taking 3 to 5 days to complete. Credit investigation is one of several functions the staff performed. Credit decisions not given attention it required. Some credit decisions and limits objectionable and not reliable.

Sales volume: $200 million

Employees: 300

Customers: 5,000

Customer of Bucar Group: 5 years

Solution:

Bucar deployed 2 analysts for the company. All credit investigations are completed in 24 hours. Each debtor is inspected according to Bucar/Company specific criteria every time, therefore recommendations are completed in a timely manner with employee-like knowledge and experience.

Result:

Credit decision turn-around time reduced to 1 day. 45% increase in limit per new customer equating to $11 million in sales and $2 million in profit.